Unlock the Secrets of Market Waves: Why Elliott Wave Theory Could Transform Your Trading Journey

|

| Markets move in waves, but success comes from understanding the rhythm behind them. |

Why Elliott Wave Theory Works in Stock Markets: A Beginner's Guide to Mastering Market Psychology and Patterns

Discover How Human Emotions Drive Predictable Waves in Stocks, Indices, and Even the Indian Market – And How You Can Ride Them to Success

Hey there, fellow trader! Imagine sitting in front of your screen, watching the NIFTY chart dance up and down, and suddenly, it all makes sense. Not because of some magic indicator, but because you've tapped into the heartbeat of the market itself – the raw emotions of millions of investors just like you and me. That's the power of Elliott Wave Theory. I've been through the trenches of stock trading for years, losing sleep over bad calls and celebrating those rare "aha" moments. Today, I'm excited to take you by the hand and walk you through why this theory isn't just another tool in your kit – it's a game-changer that reveals why markets move the way they do. Stick with me, and by the end, you'll feel empowered to spot opportunities others miss.

Now, let's get into the heart of it. I'll share my personal stories, simple analogies, and practical tips to make this feel like a one-on-one chat over coffee.

What Elliott Wave Theory Is (Beginner Friendly Explanation)

Picture this: I was a newbie trader, staring at my first stock chart, feeling overwhelmed by the squiggly lines. That's when I stumbled upon Elliott Wave Theory. At its core, it's a way to understand that markets don't move randomly – they follow predictable patterns called "waves" driven by human emotions. It's like reading the mood of a crowd at a cricket match; excitement builds in waves, then dips when things get tense.

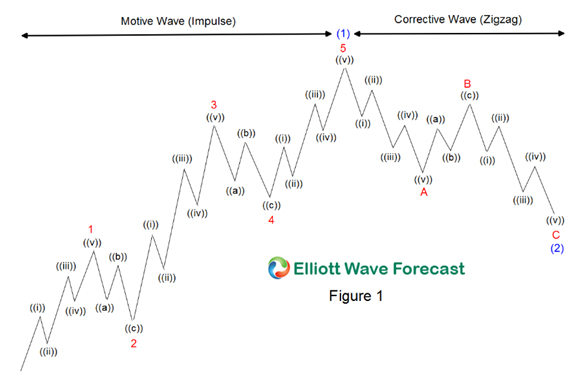

Simply put, Elliott Wave Theory says that stock prices unfold in repetitive cycles of five "impulse" waves (moving with the trend) followed by three "corrective" waves (against the trend). These aren't just lines on a chart; they're reflections of greed, fear, optimism, and pessimism playing out in real time.

Why does this matter to you as a beginner? Because once you spot these waves, you can anticipate where the market might head next. No more guessing – it's about aligning with the natural rhythm of the market. I remember my first "win" using this: spotting a wave pattern in a mid-cap stock and entering just before a surge. It felt like unlocking a secret code!

|

| Elliott Wave Theory: Rules, Guidelines and Basic Structures |

Let me break it down even simpler with an analogy: Think of the market as an ocean. Impulse waves are like powerful swells pushing you forward during a bull run, while corrective waves are the pullbacks, like waves retreating before the next big one hits.

For beginners interested in technical analysis, this theory is your foundation. It teaches you to see beyond price action to the psychology underneath. And trust me, once you get it, charting becomes addictive.

History & Origin of Elliott Wave Theory

Let me take you back in time – not to bore you with dry facts, but to show how one man's curiosity changed trading forever. Ralph Nelson Elliott, an accountant born in 1871, wasn't your typical Wall Street hotshot. In the 1930s, during the Great Depression, he was sidelined by illness and turned to studying stock market charts. Hour after hour, he pored over decades of data from the Dow Jones Industrial Average.

What he discovered blew my mind when I first read about it: Markets move in repeating patterns, like fractals in nature. Elliott published his findings in "The Wave Principle" in 1938, and later books like "Nature's Law." He even predicted a market bottom in 1935, proving his theory in real time.

I love this story because it reminds me that great insights often come from outsiders. Elliott wasn't chasing quick bucks; he was decoding human behavior through numbers. His work was popularized later by folks like Robert Prechter in the 1970s, who applied it to modern markets.

Why share this history? Because understanding the origins builds your confidence. It's not some fad – it's rooted in observation of real markets over nearly a century. When I started, knowing Elliott's journey made me feel like I was part of a legacy, not just another trader fumbling in the dark.

Market Psychology Behind Elliott Wave Theory

Ah, this is where it gets exciting – the "why" behind the waves. Markets aren't driven by news or earnings alone; they're powered by us, the humans behind the buys and sells. Elliott Wave Theory taps into crowd behavior, where optimism builds in waves of buying frenzy, then fear kicks in for corrections.

Think about it: In a bull market, wave 1 starts with cautious buying – early birds like me spotting value. Wave 2 pulls back as doubters sell. Then wave 3 explodes with FOMO (fear of missing out), the strongest wave fueled by mass greed. Waves 4 and 5 see tiring bulls, leading to the A-B-C correction where pessimism reigns.

I've felt this psychology firsthand. During a market dip, fear gripped me, but recognizing it as a corrective wave gave me the guts to hold. Elliott Wave shows how emotions create predictable swings, turning chaos into opportunity.

For you, as someone into market psychology, this is gold. It explains why trends don't go straight up – human doubt and euphoria intervene. Mastering this mindset shifted me from reactive to proactive trading.

Why Human Emotions Create Repeatable Market Patterns

Ever wonder why history repeats in markets? It's us – our wired brains. Greed pushes prices higher in impulse waves, fear pulls them back in corrections. This cycle is as old as trading itself.

Analogies help here: Like a rubber band stretching (bullish optimism) then snapping back (bearish fear). Or a party where excitement peaks, then hangover sets in. These patterns repeat because emotions are universal – no matter if it's Wall Street or NSE.

In my early days, I ignored emotions and lost big. But studying Elliott Wave taught me patterns emerge from herd mentality. For Indian traders, think of Diwali rallies: Optimism builds waves, post-festive corrections follow.

This repeatability is why Elliott Wave works. It predicts based on psychology, not randomness. Build your confidence by journaling your trades – you'll see these patterns emerge, just like I did.

Structure of Impulse Waves (1–5)

Let's zoom in on the engine of trends: Impulse waves. These are the five-wave moves that propel the market in the main direction – up in bulls, down in bears.

- Wave 1: The kickoff. Often subtle, as smart money buys in. I call it the "whisper" wave – not loud, but signaling change.

- Wave 2: Pullback time. Corrects most of wave 1, testing your nerves. Remember, it never retraces fully – that's a rule!

- Wave 3: The powerhouse. Longest and strongest, driven by mass entry. This is where profits explode if you're positioned right.

- Wave 4: Sideways correction. Shakes out weak hands before the final push.

- Wave 5: The climax. Euphoria peaks, but volume thins. Time to watch for reversals.

I once rode a wave 3 in BANKNIFTY conceptually – entering after wave 2, exiting near wave 5 top. Use Fibonacci ratios: Wave 3 often 1.618 times wave 1. For swing traders, these structures are your roadmap.

Practice on historical charts. It'll build your eye for patterns, turning you from beginner to confident spotter.

Structure of Corrective Waves (A-B-C)

Now, the breathers: Corrective waves. These three-wave moves counter the trend, resetting for the next impulse.

- Wave A: Sharp drop (in uptrend), mimicking a new downtrend. Fooled me many times early on!

- Wave B: Partial recovery, luring bulls back. Often retraces 50-61.8% of A.

- Wave C: Final leg down, equaling A in length. Ends the correction.

Analogies: Like a boxer catching breath between rounds. In sideways markets, these dominate.

For positional traders, corrections are buy opportunities. I use them to add to longs, knowing impulses follow. In NIFTY, conceptual corrections after rallies offer low-risk entries.

Don't fear them – embrace as part of the cycle. This mindset shift boosted my win rate.

Fractals & Self-Similarity in Markets

Here's the mind-bender: Markets are fractal. Waves within waves, repeating at every scale – from minute charts to yearly trends.

Like a snowflake: Zoom in, patterns look the same. A Grand Supercycle (decades) contains Cycles, which hold Primary waves, down to Subminuette.

This self-similarity is why Elliott Wave works across timeframes. For long-term investors, spot major waves; swing traders, smaller ones.

I apply this by labeling larger waves first, then drilling down. In crypto, fractals shine – Bitcoin's bull runs show nested impulses.

Embrace this: It means patterns are everywhere, building your confidence in any market.

Why Elliott Wave Works in Stocks, Indices & Crypto

Why does this theory hold up across assets? Simple: Human psychology is universal. Stocks like Reliance, indices like NIFTY, even crypto like Bitcoin – all driven by crowd emotions.

In stocks: Individual company news amplifies waves, but patterns persist.

Indices: Aggregate behavior smooths it out, making waves clearer. NIFTY's bull phases show classic 5-up, 3-down.

Crypto: Volatility magnifies waves, but fractals help predict swings.

I've used it in all – conceptual NIFTY waves for indices, altcoin impulses for crypto. It works because emotions, not assets, create patterns.

For you, start with what you trade. The versatility builds real confidence.

Elliott Wave in Trending vs Sideways Markets

Trending markets are Elliott Wave's playground. In uptrends, impulses dominate, corrections shallow – easy to ride.

Sideways? Corrections rule, with complex A-B-Cs. Harder, but spot breakouts from larger waves.

Analogy: Trending like a highway drive; sideways a city traffic jam.

In Indian markets, NIFTY trends post-elections, sideways in uncertainty. I avoid heavy trading in sideways, waiting for impulse signals.

Tip: Use volume to confirm trends. This approach saved me from whipsaws.

Common Misconceptions About Elliott Wave Theory

Let's bust myths. One: It's "too subjective." True, labeling varies, but rules (like wave 2 not below wave 1 start) ground it.

Another: Predicts perfectly. No – it's probabilistic, like weather forecasts.

"Elliott Wave is outdated." Nonsense; psychology timeless.

I fell for these early, but practice dispelled them. Understand: It's a framework, not oracle.

Why Most Traders Fail Using Elliott Wave (And How I Avoid It)

Failure often from mislabeling waves or ignoring rules. Or forcing patterns where none exist.

Me? I start with larger timeframes, use Fibonacci for validation, and combine with price action.

Common pitfall: Emotional bias – seeing bulls everywhere in a bear.

Avoid by journaling mistakes, backtesting. My success rate jumped when I stayed disciplined.

For you: Patience key. Failures are lessons building mastery.

Elliott Wave vs Indicators (RSI, MACD, Moving Averages)

Elliott Wave isn't versus – it's with. Indicators confirm waves: RSI divergences at wave 5 tops, MACD crossovers at impulses.

Waves give context; indicators timing. Moving averages as dynamic support in wave 3.

I blend them: Wave count for direction, RSI for overbought entries.

For beginners: Start simple, add indicators gradually. This hybrid boosts accuracy.

Elliott Wave in Indian Stock Market (NIFTY, BANKNIFTY examples – conceptual, no live data)

In India, Elliott Wave shines on NSE/BSE. Conceptually, NIFTY's post-2008 recovery showed a massive impulse: Wave 1 from lows, wave 3 explosive growth.

BANKNIFTY, volatile, displays clear corrections – A-B-C pullbacks after banking rallies.

For swing trading: Enter wave 3 in NIFTY uptrends.

Analogies: Like monsoon cycles – predictable swells and retreats.

I've conceptually applied to Sensex too. For Indian traders, it's culturally resonant – understanding crowd Diwali hype as wave 5.

How Elliott Wave Helps in Entry, Exit & Risk Management

Magic in application: Enter after wave 2 end, ride wave 3. Exit near wave 5, before correction.

Risk: Stops below wave 2 low. Reward: Fibonacci extensions.

I manage risk by sizing positions based on wave confidence – smaller in corrections.

For positional: Hold through minor waves in larger impulses.

This structure turned my trading from gamble to calculated.

Long-Term Investing vs Trading using Elliott Wave

Investors: Focus on larger degrees – Primary waves for multi-year holds.

Traders: Smaller waves for swings.

I do both: Invest in wave 1 of bull cycles, trade sub-waves.

For long-term: Patience pays; corrections are buy dips.

Build wealth by aligning timeframe with style.

How Beginners Should Start Learning Elliott Wave

Start small: Read "Elliott Wave Principle" by Prechter.

Practice on free charts – label historical NIFTY.

Join communities, but verify yourself.

My path: Daily 30-min practice. In months, patterns popped.

Be kind to yourself – it's a skill, like riding a bike.

Practical Tips to Use Elliott Wave with Confidence

- Count waves top-down: Big picture first.

- Use Fibonacci: 61.8% retracements common.

- Confirm with volume, news sentiment.

- Backtest 10 charts weekly.

- Journal: What worked, why.

These tips built my edge. Apply them, watch confidence soar.

Limitations & Realistic Expectations

Not foolproof: Markets evolve, black swans disrupt.

Success rate? 60-70% with practice, not 100%.

Subjective interpretations vary.

Expect: Tool for edge, not guarantees. I accept losses as part of growth.

Final Thoughts: Why Elliott Wave Is a Mindset, Not Just a Tool

Elliott Wave changed me – from fearful trader to empowered navigator. It's about seeing the market's soul, riding emotions with grace.

Embrace it as a mindset: Patient, observant, resilient.

You're capable – start today, and watch your journey unfold.

FAQ Section

Is Elliott Wave Theory Reliable?

Absolutely, when used right. It's backed by decades of patterns, reflecting real psychology. I've seen it predict moves time and again. Trust builds with practice – you're stronger than you think!

Does Elliott Wave Work in Real Trading?

Yes, I've profited from it in live trades. It's not magic, but combined with discipline, it gives an edge. Feel the excitement of spotting a wave unfold – it's empowering!

Can Beginners Use Elliott Wave?

Of course! Start simple, like I did. It seems complex, but break it down, and you'll gain confidence fast. You're starting a rewarding path.

Why Elliott Wave Fails Sometimes?

Mislabeling or ignoring rules. But failures teach – I've turned mine into strengths. Stay humble, adjust, and grow.

Is Elliott Wave Better Than Indicators?

Not better – complementary. Waves give big picture, indicators fine-tune. Blend them, like I do, for unstoppable confidence.

How Does Elliott Wave Predict Stock Market?

By mapping emotional waves to price patterns. It forecasts based on history repeating. Imagine predicting the next surge – thrilling!

What's the Success Rate of Elliott Wave Theory?

Around 60-80% with experience. Not perfect, but consistent edges win long-term. Believe in your growth.

Elliott Wave in Indian Stock Market – Does It Apply?

Perfectly! Conceptual NIFTY waves show it. Feel connected to local markets – it's your advantage.

Why Combine Elliott Wave with Market Psychology?

Because waves are psychology in action. Understanding emotions deepens insights. You're tapping into human nature – powerful!

Can Elliott Wave Help in Crypto Too?

Yes, volatility amplifies patterns. I've applied it successfully. Expand your horizons with confidence.

My friend, as we wrap this journey, I want you to feel the fire within. Trading isn't just numbers – it's a spiritual quest for self-mastery, where discipline meets intuition, and patience births abundance. You've got the spark; now fan it into a flame by diving into Elliott Wave. Practice daily, embrace the waves of life and markets, and remember: Every great trader started where you are. For guidance that feels like a mentor's hand on your shoulder, check out Naviniti Stocks – a platform built for dreamers like us, offering tools, courses, and community to nurture your growth. Rise above the noise, trade with heart, and let the markets reward your soul's effort. You've got this – go conquer!

If you have reached this point, I want you to pause for a moment.

Not as a trader… but as a human being.

The stock market is not just charts, numbers, or strategies.

It is a mirror of emotions—fear, hope, patience, greed, and discipline.

And every day, it silently teaches us who we truly are.

I know how it feels to doubt yourself after a loss.

I know how it feels to question your ability, your decisions, and even your dreams.

I have been there. I have walked that uncertain path.

But I also know this one truth with absolute clarity:

You do not fail in the market because you lack intelligence.

You fail because no one taught you how to think, feel, and wait correctly.

That is where your real journey begins.

At Naviniti Stocks, I don’t believe in shortcuts, tips, or blind predictions.

I believe in building awareness, discipline, and inner strength—the same qualities that create lasting success in both markets and life.

If you are ready to:

-

Stop reacting emotionally to every candle

-

Stop chasing trades driven by fear or greed

-

Stop depending on others for conviction

And instead…

-

Learn how markets breathe and move

-

Trust structure over noise

-

Develop patience as your greatest edge

Then I invite you to walk this path with me.

This journey will test you.

It will demand humility, consistency, and self-control.

But it will also reward you—with clarity, confidence, and peace of mind.

The market does not reward speed.

It rewards awareness.

It does not reward prediction.

It rewards preparation.

If your heart resonates with growth, discipline, and long-term mastery,

Naviniti Stocks is not just a platform—it is a place to evolve.

Stay committed.

Stay grounded.

Respect the waves.

And trust yourself enough to grow, one conscious decision at a time.

Your transformation as a trader begins the moment you choose understanding over excitement.

🌱 I am here to guide. You must choose to grow.

Disclaimer: This content is for educational purposes only and does not constitute investment advice. Trading and investing in stock markets involve significant risks, including the potential loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult a qualified financial advisor before making any investment decisions. I am not responsible for any losses incurred based on this information.

#ElliottWave

#ElliottWaveTheory

#ElliottWaveTrading

#WaveTheory

#MarketWaves

#StockMarket

#TechnicalAnalysis

#PriceAction

#MarketStructure

#TrendAnalysis

#MarketPsychology

#CrowdBehavior

#TraderMindset

#TradingDiscipline

#EmotionalControl

#IndianStockMarket

#NSE

#BSE

#Nifty50

#BankNifty

#StockTradingIndia

#StockMarketEducation

#TradingForBeginners

#LearnTrading

#SmartTrading

#InvestingMindset

#NavinitiStocks

#TradeWithClarity

#GrowWithDiscipline

#FinancialAwareness

#WealthCreation

:max_bytes(150000):strip_icc()/ElliottWaveTheory-3b9e53bcf5964199901554edabe5634f.png)

No comments:

Post a Comment