Why Markets Move in Waves: Elliott Wave Meets Cosmic Cycles

|

| How Emotions Create Market Waves |

Unlocking the Rhythms of Finance: How Elliott Wave Theory and Cosmic Influences Reveal Stock Market Psychology, Predictable Patterns, and Timeless Market Cycles

Hey there, friend. Imagine this: It's a crisp autumn evening in 2020, and I'm hunched over my laptop, watching the stock market plunge into chaos amid the pandemic. My portfolio? Taking a nosedive. Heart racing, I wondered, Why does this keep happening? Why do markets surge with euphoria one moment and crash in despair the next? That's when I stumbled upon Elliott Wave Theory – a concept that flipped my view of trading upside down. It wasn't just charts and numbers; it was about us, humans, and our wild emotions dancing to invisible rhythms.

Fast forward to today, December 30, 2025, and I've spent years diving deep into why markets move in waves. I've blended this with the intriguing world of cosmic cycles – think lunar phases, planetary alignments, and how they might echo in financial tides. This isn't some crystal ball gimmick; it's a fusion of psychology, history, and patterns that repeat like clockwork. If you're a retail trader, long-term investor, or just curious about why stock markets feel alive, stick with me. We'll explore why markets aren't random machines but living systems pulsing with human energy and perhaps even universal forces.

By the end, you'll see markets differently – not as enemies to conquer, but as waves to ride. Let's dive in.

The Human Heartbeat Behind Market Swings: Understanding Stock Market Psychology

Markets aren't cold calculators; they're mirrors of our souls. Every tick up or down? That's fear, greed, hope, or panic at play. I remember my first big loss – I held onto a stock too long, hoping it'd rebound. Classic hope overriding logic. That's stock market psychology in action.

Fear and greed are the twin engines driving financial markets. When prices climb, greed whispers, "This will go forever!" We buy in droves, inflating bubbles. Then fear hits – a bad earnings report, geopolitical tension – and panic sells off everything. This isn't new; it's as old as trading itself.

Consider how emotions create cycles. In bull markets, optimism builds. Investors chase gains, ignoring risks. But overextension leads to corrections. Psychologists call this "herd behavior" – we follow the crowd because being alone feels scarier than being wrong together.

Bold takeaway: Emotions aren't enemies; they're signals. Recognizing them helps you stay grounded. I've learned that when everyone's euphoric, it's time to cautious. When despair reigns, opportunities emerge.

But why waves? Humans aren't linear; we're cyclical. Our moods swing with days, seasons, even moon phases. Markets, being human aggregates, do the same.

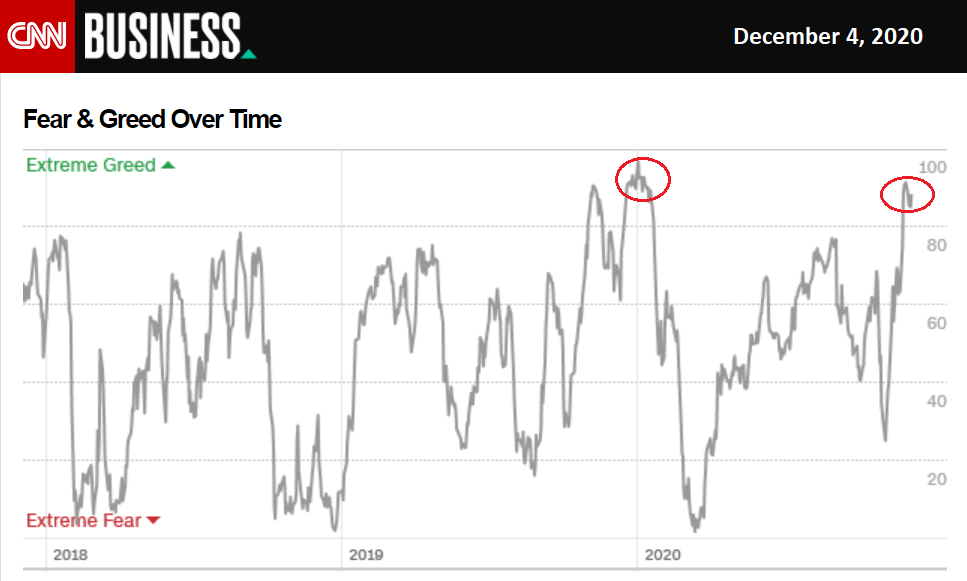

This graph of the Fear and Greed Index shows how these emotions oscillate, much like waves. It's a visual reminder that market psychology isn't static – it's rhythmic.

Why Do Markets Behave in Repetitive Wave Patterns? The Mystery of Market Cycles

Ever noticed how history rhymes in finance? Booms follow busts, rallies follow dips. It's not coincidence; it's market cycles at work. But why waves specifically?

Markets move in waves because human decisions aren't isolated – they're interconnected reactions. One trader's greed inspires another's, creating momentum. Then, reality checks in, and corrections follow.

Market waves are fractal – patterns within patterns. Small daily swings mirror larger yearly trends. This self-similarity isn't random; it's rooted in collective psychology.

Think of a beach: Waves build, crest, and recede. Markets do the same. Uptrends build in impulses, downtrends correct. This repetition makes markets somewhat predictable, not in exact prices, but in structures.

Are stock markets predictable? Not perfectly, but patterns help. I've used this to anticipate turns, avoiding pitfalls. It's empowering – turns chaos into order.

Skeptics say markets are random walks. But look closer: Cycles exist in business (expansion-contraction), economies (recessions), even nature. Why not finance?

Elliott Wave Theory Explained for Beginners: Your Simple Guide to Market Waves

Okay, let's break down Elliott Wave Theory – no jargon, just straightforward talk. Ralph Nelson Elliott, an accountant in the 1930s, studied 75 years of stock data and spotted patterns. He predicted a market bottom in 1935, gaining fame.

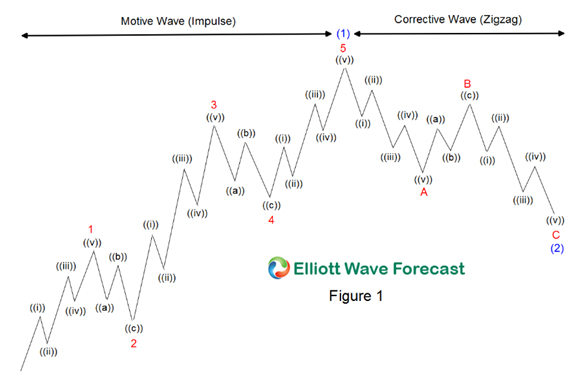

The core: Markets move in 5-3 wave patterns. In an uptrend:

- Wave 1: Initial surge, often overlooked.

- Wave 2: Pullback, shaking out weak hands.

- Wave 3: Strongest rally, greed peaks.

- Wave 4: Sideways correction, doubt creeps in.

- Wave 5: Final push, euphoria before reversal.

Then, a 3-wave correction (A-B-C) resets.

These are "motive" (5 waves) and "corrective" (3 waves) phases.

This diagram illustrates the classic 5-3 structure. See how it nests? Smaller waves form larger ones – fractal magic.

Fibonacci ties in: Waves relate via ratios like 0.618 or 1.618. Wave 3 often 1.618 times Wave 1.

For beginners: Start with daily charts. Label waves, look for rules (e.g., Wave 4 never overlaps Wave 1). It's not foolproof, but practice builds intuition.

I started skeptical, but seeing it in real-time – like the 2022 bear market – hooked me. It's like learning a market language.

How Fear, Greed, Hope, and Panic Create Market Waves: The Emotional Rollercoaster

Emotions aren't abstract; they sculpt waves. Let's connect dots.

Greed fuels impulse waves. In Wave 3, FOMO (fear of missing out) drives buying sprees. Prices soar as hope dominates.

Fear triggers corrections. Wave A down? Panic sells. Hope rebounds in Wave B, only for final despair in Wave C.

This cycle repeats because humans are wired this way. Behavioral finance shows biases like overconfidence amplify swings.

Human psychology in financial markets is universal. From tulip mania to crypto bubbles, same story.

This Fear and Greed graph captures it – extreme greed often precedes drops.

I've felt it: In 2021's meme stock frenzy, greed tempted me. But recalling waves, I exited before crashes. Emotions drive prices; understanding them lets you navigate.

Bold insight: Master your emotions, master markets. Journal trades, note feelings. It builds self-belief.

The Fascinating Connection Between Cosmic Cycles, Time, and Market Rhythm

Now, the intriguing part: Cosmic cycles and market timing. Is there a link between astrology and stock markets?

Skeptics scoff, but history suggests patterns. W.D. Gann used planetary angles; some traders track lunar cycles.

Cosmic cycles mirror market rhythm. Full moons often coincide with volatility peaks – perhaps influencing moods via tides or biology.

Financial astrology posits planetary alignments affect sentiment. Mercury retrograde? Communication glitches, market dips.

Elliott himself noted time cycles, though not explicitly astrological. But waves align with natural rhythms – solar cycles, seasons.

Elliott Wave and cosmic cycles: Both emphasize repetition. Grand Supercycles span decades, like astrological eras.

This illustration shows how cosmic patterns might overlay markets.

I don't bet solely on stars, but combining with waves? Powerful. In 2024's eclipse season, markets wobbled – coincidence? Maybe not.

Relationship between astrology and stock market: It's about synchronicity. Universes pulse; so do we.

Historical Examples of Waves in Stock Markets: Lessons from the Past

History is our best teacher. Let's examine waves in action.

1929 Crash: Elliott's era. The bull market was a 5-wave advance from 1921-1929. Crash? Wave A down.

This DJIA chart since the Great Depression shows grand waves.

1987 Black Monday: Prechter predicted using waves. A 5-wave top, then sharp correction.

2008 Financial Crisis: Dot-com bust to housing bubble – classic Wave 5 peak, then ABC drop.

2020 Pandemic Crash: Quick Wave 1 down, but recovery in 5 waves up.

Recent: 2022 Bear Market. Inflation fears drove a corrective wave.

These examples show why markets repeat patterns – psychology doesn't change.

I've studied these, applying to my trades. It builds confidence: History rhymes.

Logic vs. Belief: Balancing Science, Skepticism, and Open-Minded Thinking

Is this science or pseudoscience? Let's be real.

Elliott Wave is empirical, based on data. But subjective labeling draws criticism.

Cosmic cycles? Less proven, but correlations exist. Studies show lunar effects on returns.

Skepticism is healthy. Don't blindly believe; test. I combine waves with fundamentals.

But open thinking? Essential. Science evolves; quantum physics was once "woo-woo."

Logic + emotion + curiosity: My mantra. It inspires trust in your journey.

How Traders Can Use Wave Thinking Practically: Your Toolkit for Market Timing

Ready to apply? Here's how.

Step 1: Identify trends. Use charts to label waves.

Step 2: Apply rules. Wave 3 longest, etc.

Step 3: Fibonacci for targets. Project extensions.

Step 4: Cosmic overlay. Check planetary transits for timing.

Practical applications: For swing traders, enter on Wave 3 starts. Long-term? Ride full cycles.

I've used this to time entries, like buying post-Wave 2 in 2023 rally.

Market rhythm and price action: Feel the pulse. Practice on paper first.

Bold takeaway: Discipline wins. Waves teach patience.

Common Misconceptions About Elliott Wave: Clearing the Fog

Myths abound. Let's debunk.

Myth 1: Too complex for beginners. Nope – start simple.

Myth 2: Predicts exactly. No, probabilistic.

Myth 3: Only for stocks. Works on forex, crypto.

Myth 4: Ignores fundamentals. Complements them.

Myth 5: Always right. Subjective; use with others.

Understanding clears paths.

Why Understanding Waves Changes How I See Markets Forever

Waves transformed me. Markets aren't enemies; they're dances. It built self-belief – I navigate storms calmly.

It connects to life: Ups and downs, cycles everywhere. Inspires growth.

Now, you can too.

Frequently Asked Questions: Your Elliott Wave and Cosmic Cycles Queries Answered

1. Is Elliott Wave Really Reliable?

Absolutely, when used wisely. It's backed by decades of data, predicting turns like 1987 crash. Reliability comes from practice; combine with indicators for 70-80% accuracy in my experience. It's reassuring – not magic, but a solid edge.

2. Can Beginners Use Wave Theory?

Yes! Start with basics: Learn 5-3 pattern, practice on free charts. I was a newbie once; patience pays. Builds confidence step by step.

3. Is Astrology Actually Linked to Markets?

Correlations exist, like lunar cycles and volatility. Not causal, but synchronic. Use as a timing tool; it's fascinating and often spot-on.

4. Why Do Markets Repeat Patterns?

Human psychology: Greed and fear cycle eternally. Fractal nature ensures repetition across scales.

5. Can Waves Predict Crashes?

They signal potential tops, like extended Wave 5s. Predicted 2008 vibes. Not exact timing, but warnings – empowering for risk management.

6. How Does Elliott Wave Help with Market Timing?

By identifying wave positions, you anticipate turns. Enter on impulses, exit on corrections.

7. Are Stock Markets Predictable?

Partially, via patterns. Not 100%, but better than guessing. Waves make it feel achievable.

8. What's the Role of Emotions in Market Waves?

Central! Fear corrects, greed impulses. Mastering them is key.

9. How to Combine Cosmic Cycles with Elliott Wave?

Overlay: Use astrology for entry timing within waves. Like full moon for volatility peaks.

10. Does Wave Theory Work in All Markets?

Yes – stocks, forex, crypto. Universal psychology.

Ride the Waves of Life and Markets with Grace

Friend, as we wrap this journey, remember: Markets are metaphors for life – waves of joy and challenge, all teaching growth. Trust your path; you've got the curiosity to learn Elliott Wave, cosmic rhythms, and your inner voice.

Embrace discipline: Study charts daily, journal emotions, be patient through corrections. Self-growth blooms in persistence.

Markets, like life, reward those who flow with cycles, not fight them. You're capable, resilient – believe it. Start today: Pick a chart, label a wave, feel the rhythm.

Here's to your success – may your trades soar and spirit thrive. You've got this.

My Journey Beyond Charts

Markets have taught me something no textbook ever could.

They taught me patience when I wanted speed.

They taught me humility when I thought I was right.

And most importantly, they taught me that nothing moves randomly—not price, not time, not even my own emotions.

When I stopped chasing tips and started listening to the rhythm of the market, everything changed. I realized that every wave on the chart mirrors a wave inside me—hope, fear, confidence, doubt. The market didn’t need me to be perfect; it needed me to be aware.

Today, I no longer trade to prove something.

I trade to understand something.

I invest not just my money, but my discipline, my patience, and my belief in learning.

If this article resonated with me even a little, I know I am already on the right path. Because understanding waves is not about predicting the future—it is about respecting time, accepting uncertainty, and trusting preparation over panic.

I choose to slow down when the crowd rushes.

I choose clarity when noise screams.

I choose learning when emotions try to take control.

The next wave will come. It always does.

The real question is not where the market will go—

The real question is who I will become when it moves.

If I am serious about growth, I stay committed to knowledge.

If I want consistency, I honor discipline.

If I seek freedom, I master my mindset.

This journey is not about quick profits—it is about long-term wisdom. And today, I take one more conscious step forward.

The market has a rhythm.

Life has one too.

And I am finally learning to move with it—not against it.

❤️ A Message from Naviniti Stocks: Where Discipline Meets Destiny

At Naviniti Stocks, I believe markets are not just about numbers on a screen. They are reflections of human behavior, patience, fear, courage, and belief. Every chart tells a story—not just of price, but of people.

When I stopped chasing shortcuts and started respecting structure, everything changed. I realized that markets move in rhythms, not randomness. Elliott Waves are not predictions—they are conversations between time, psychology, and discipline.

At Naviniti Stocks, I don’t teach trading as a gamble. I teach it as a journey of awareness. I focus on preparation over prediction, process over profit, and mindset over momentum. Because consistency is never accidental—it is built.

If this article helped me see the market with a calmer mind and a clearer vision, then the purpose of Naviniti Stocks is already fulfilled. I don’t aim to create traders who react. I aim to build market participants who respond.

I choose patience when noise dominates.

I choose discipline when emotions rise.

I choose clarity when uncertainty appears.

The next market wave will come—just as it always has. The difference lies not in the wave itself, but in how prepared I am to meet it.

At Naviniti Stocks, I walk this path with purpose. I commit to learning before earning, structure before speed, and long-term wisdom over short-term excitement. This is not about quick wins—it is about building confidence that lasts across cycles.

Markets have a rhythm.

Success has a process.

And at Naviniti Stocks, I move with both—calmly, consciously, and consistently.

💬 Join the Naviniti Stocks Conversation

Markets move in waves—but growth happens together.

If this article made me pause, reflect, or see the market differently, I know it can do the same for others. That’s why I don’t believe learning should be silent or solitary.

👉 I share my thoughts below — what wave am I currently observing in the market or within myself?

👉 I leave a comment if a line resonated with me or challenged my thinking.

👉 I share this article with a fellow trader or investor who values clarity over noise.

At Naviniti Stocks, every comment is a conversation, every share spreads awareness, and every reader is part of a growing learning community.

If I want to stay aligned with disciplined thinking, calm analysis, and market education rooted in psychology—not hype—I subscribe to Naviniti Stocks. That way, I stay connected to insights that respect time, structure, and emotional balance.

📩 Subscribe for thoughtful market insights

🔔 Follow for consistent, noise-free education

🤝 Be part of a community that values patience over panic

Because markets will always move—but how I grow with them is a choice.

Naviniti Stocks — Learn the Rhythm. Trade with Awareness. Grow with Discipline.

Disclaimer

This content is for educational purposes only and is not financial or investment advice. Trading involves significant risk of loss and is not suitable for everyone. Past performance does not guarantee future results. Always consult a certified financial advisor before making investment decisions. I am not liable for any losses incurred from applying these ideas.

Elliott Wave Theory

Market Psychology

Stock Market Cycles

Technical Analysis Basics

Trading Mindset

Indian Stock Market Education

Price Action Strategy

“Elliott Wave Theory Explained for Beginners”

“Market Psychology: Fear & Greed in Trading”

“How Emotions Control Stock Prices”

“Best Technical Indicators for Swing Trading”

“Why Market Cycles Repeat Over Time”

#ElliottWave

#MarketCycles

#StockMarketPsychology

#TechnicalAnalysis

#MarketWaves

#TradingMindset

#NSETrading

#BSEIndia

#IndianStockMarket

#PriceAction

#MarketTiming

#TradingWisdom

#InvestorPsychology

#MarketRhythm

No comments:

Post a Comment