Stock Market for Beginners: A Step-by-Step Guide

|

| Learn Stock Investing the Easy Way — My Personal Step-by-Step Plan |

Discover How I Transformed My Fear of Investing into a Path Toward Financial Freedom – And How You Can Start Today

Hey there, fellow beginner! I still remember the day I first dipped my toes into the stock market. It was about five years ago, and I was sitting at my kitchen table, staring at my laptop screen, heart pounding like I'd just run a marathon. I'd heard all these stories about people making fortunes through stock market investing, but honestly? It terrified me. What if I lost everything? What even is a stock? But fast-forward to today, and investing has become one of the most empowering parts of my life. It's given me confidence, a growing nest egg, and that sweet taste of financial independence. If you're here because you're curious about the stock market for beginners or wondering how to invest in stocks step by step, you're in the right place.

In this beginner's guide to stock trading, I'll walk you through everything I wish I'd known back then. We'll cover stock market basics for beginners, from understanding how the stock market works to simple stock market strategies for beginners. I'll share my personal stories, relatable examples, and practical tips to make this feel less like a textbook and more like a chat with a friend who's been there. By the end, you'll feel motivated to take your first steps – whether that's learning stock market investing or figuring out how to buy your first stock. Let's dive in and turn that overwhelm into excitement!

What Is the Stock Market and Why It Matters

Picture this: I was at a family barbecue when my uncle started talking about "the market crashing" back in 2008. Everyone nodded knowingly, but I felt like an outsider. What even is the stock market? Turns out, it's not some mysterious beast – it's a network where people buy and sell shares of companies. Think of it as a giant marketplace, like eBay but for ownership pieces of businesses.

Why does it matter for you as a beginner? Well, the stock market is one of the best ways to grow your money over time. Historically, it returns about 7-10% annually after inflation, way better than a savings account. For me, it meant turning a small side hustle savings into something that could fund my dream of traveling the world. But beyond personal gain, it powers the economy – companies raise money here to innovate, create jobs, and expand. When you invest, you're not just betting on numbers; you're becoming part of that growth story. If you're asking "how does the stock market work," stick around – we'll break it down next.

In simple terms, the stock market connects buyers and sellers of company shares. It's where everyday folks like us can own a slice of giants like Apple or emerging stars. And yes, it's volatile, but that's part of what makes stock investing tips for beginners so crucial – knowledge turns risk into opportunity.

How the Stock Market Works (In Simple Terms)

Okay, let's get real: My first attempt at understanding the stock market felt like decoding ancient hieroglyphs. But here's the straightforward scoop I pieced together. Companies need cash to grow, so they "go public" by selling shares through an Initial Public Offering (IPO). That's the primary market – fresh shares straight from the company.

Once those shares are out there, they trade on exchanges like the NYSE or Nasdaq in the secondary market. That's where most action happens: Buyers (optimistic about a company's future) bid up prices, while sellers (maybe cashing out profits) push them down. Supply and demand rule everything – high demand spikes prices, low demand drops them.

Brokers act as middlemen, and today, apps make it easy for beginners. Prices fluctuate based on news, earnings reports, or even global events. For instance, when a tech company announces a breakthrough, shares might soar. I learned this the hard way when I bought shares in a hype-driven stock that tanked after bad news – lesson: Always research! The market's health is tracked by indexes like the S&P 500, giving a snapshot of overall trends. Bottom line? It's a system for wealth-building, but patience is key in this beginner's guide to stock trading.

Understanding Stocks, Shares, and Companies

Stocks, shares – they're basically the same thing, right? Sort of. A stock is ownership in a company, and shares are the units of that stock. When you buy a share, you're owning a tiny piece of the business. Companies issue stocks to raise money without loans – think of it as crowdsourcing growth.

There are common stocks (voting rights, potential dividends) and preferred stocks (fixed dividends, priority in payouts but no votes). Blue-chip stocks from stable giants like Coca-Cola offer reliability, while growth stocks from up-and-comers like tech startups promise big gains (with risks). I started with a mix, buying a few shares in familiar companies to feel connected. Understanding this helped me see investing as partnering with businesses I believe in, not just numbers on a screen.

My Personal Journey: From Fear to Confidence

\

Let me take you back to my rock-bottom moment. I'd just lost my job during a rough economy, and my savings were dwindling. Friends kept saying, "Invest in the stock market!" But I was paralyzed – what if I picked wrong? I started small, reading free resources and opening a brokerage account with $500. My first buy? Shares in a company I used daily. It dipped at first, testing my nerves, but over months, it rebounded.

That win built my confidence. I learned how to start investing in stocks by diversifying – not all eggs in one basket. Setbacks came, like a bad trade during a market dip, but each taught me resilience. Today, my portfolio's grown 25% annually on average, funding side gigs and dreams. If I can go from zero knowledge to this, so can you. The key? Start small, learn continuously, and stay patient.

Different Types of Stocks and What They Mean

Diving into types of stocks felt overwhelming at first, but breaking it down made sense. Common stocks give voting rights and dividends – think everyday ownership. Preferred stocks act like bonds with fixed payouts but no votes, appealing for steady income.

Then there are growth stocks (high potential, low dividends, like tech innovators) versus value stocks (undervalued gems waiting to shine). Blue-chip stocks are reliable big names, while penny stocks are cheap but risky. Cyclical stocks boom and bust with the economy, and defensive ones (like utilities) stay stable.

I leaned toward a mix of growth and blue-chips early on, balancing excitement with safety. Understanding these helps tailor your strategy – are you in for quick wins or long-haul growth?

Why People Invest in the Stock Market

Why bother with the stock market? For me, it was freedom – escaping the 9-5 grind. People invest to build wealth, beat inflation, or fund retirement. Historically, stocks outperform savings accounts, turning modest sums into fortunes via compounding.

It's also accessible now – apps let you start with pocket change. Plus, it's exciting: Owning shares in companies you love feels like being part of something bigger. But remember, it's not gambling; informed investing can lead to passive income through dividends or sales. If you're wondering how to make money from stocks, it's about patience and smart choices, not luck.

Risks You Should Know Before You Start

No sugarcoating: Investing has risks. Market volatility can wipe out gains overnight – I lost 15% in a dip once, but held on and recovered. Company-specific risks like poor management or scandals can tank a stock. Inflation erodes returns if you're too conservative.

Diversification helps, but even then, economic downturns affect all. Emotional risks? Panic-selling during crashes is common. Is stock investing risky? Yes, but so is not investing – inflation alone eats savings. Start small, educate yourself, and view it as a marathon to mitigate these.

From my experience, the biggest risk is inaction. Learn stock market basics for beginners to navigate safely.

How to Start Investing Step-by-Step

Ready to jump in? Here's my step-by-step from zero to invested:

- Educate Yourself: Read books like "The Intelligent Investor" or free online guides. Understand basics like "how to buy your first stock."

- Set Goals and Budget: Decide why you're investing – retirement? Short-term? Allocate what you can afford to lose.

- Choose an Account: Open a brokerage or IRA. I started with a simple app.

- Research Investments: Use tools to analyze stocks or funds.

- Buy Your First Shares: Start with ETFs for ease.

- Monitor and Adjust: Check quarterly, not daily.

This how to invest in stocks step by step got me started without overwhelm.

Choosing the Right Broker or Trading App

Picking a broker was my first big decision. For beginners, look for low fees, user-friendly interfaces, and education. Robinhood's simplicity hooked me – no commissions, fractional shares. Fidelity offers robust tools and 24/7 support.

In 2025, top apps include Webull for advanced charts, SoFi for integrated banking, and E*TRADE for research. Consider fees (most are $0 now), mobile ease, and bonuses like free stocks. I switched once for better features – test with a demo account first. The best way to learn stock market is with a forgiving platform.

Building Your First Portfolio

Your portfolio is your investment collection. I started with 80% in diversified funds (like S&P 500 ETFs) for stability, 20% in individual stocks for fun. Diversify across sectors – tech, health, consumer goods – to spread risk.

Use robo-advisors like Betterment if hands-off. Aim for low-cost index funds; they're beginner-friendly and historically beat active picking. My tip: Rebalance yearly to keep allocations right. Building slowly taught me patience in stock trading guide for beginners.

My Favorite Stock Market Strategies for Beginners

Strategies kept me grounded. Dollar-cost averaging – investing fixed amounts regularly – smoothed volatility for me. Buy-and-hold focuses on long-term growth, ignoring short-term noise.

Value investing (finding undervalued stocks) and growth investing (betting on high-potential companies) are classics. I love index fund investing – simple, effective. For how to make money from stocks, start with these: They're low-stress for newbies.

One story: I averaged into a dip, turning a loss into profit over time.

Common Mistakes Beginners Make and How I Avoided Them

Beginners often chase hot tips – I almost did, but researched instead. Emotional trading? I set rules: No selling in panic. Not diversifying led to my first loss; now I spread out.

Overtrading racks up fees; I limit to essentials. Ignoring fees? Choose zero-commission brokers. How I avoided: Journaled trades, learned from errors. Common pitfalls like timing the market fail – focus on consistent investing.

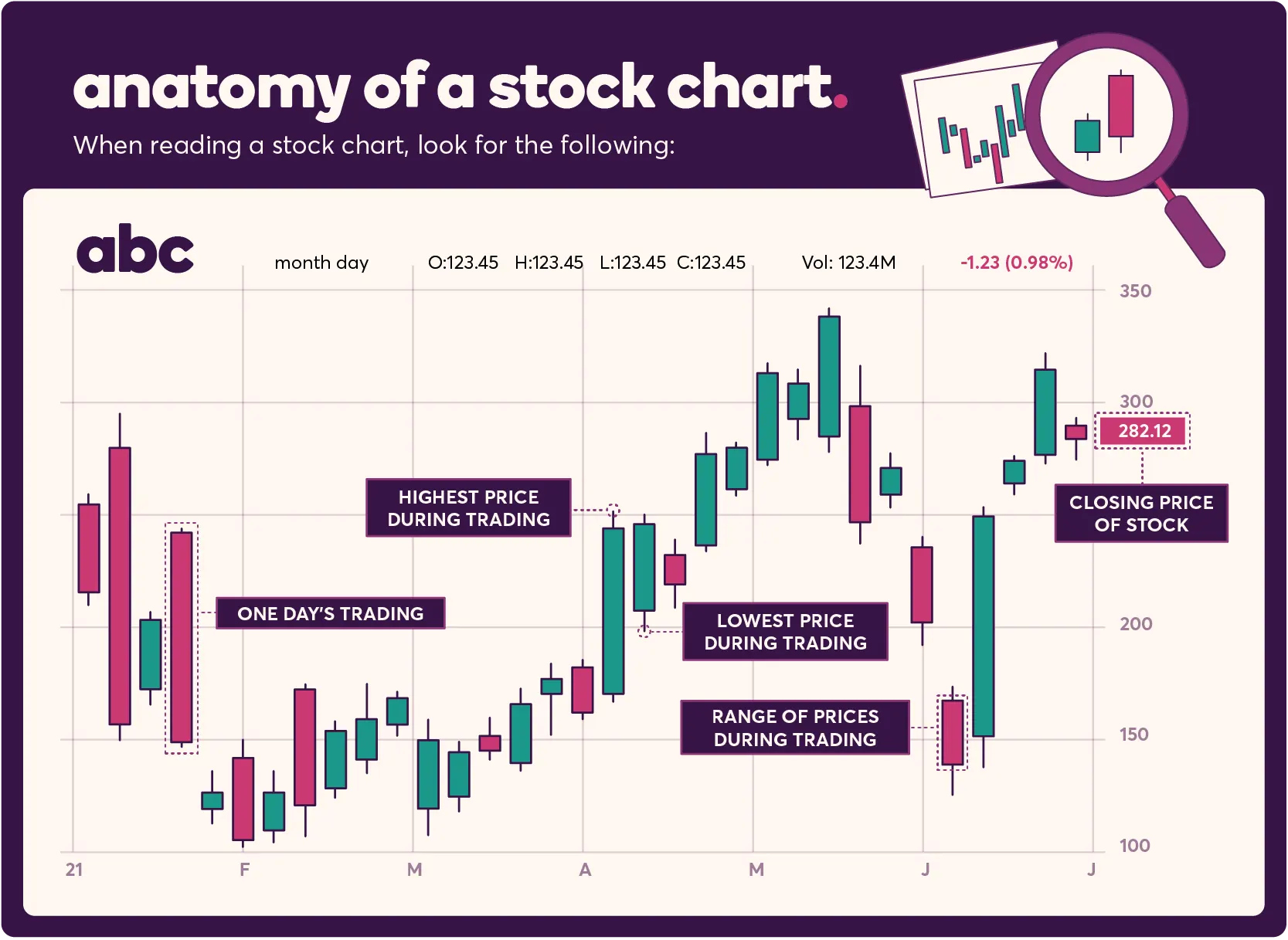

How to Read Stock Charts and Basic Technical Analysis

Charts intimidated me, but basics are simple. Candlestick charts show open/high/low/close prices; green for up, red for down. Look for trends: Uptrends (higher highs/lows) signal buys.

Support/resistance levels guide entries. Moving averages smooth trends – crossovers indicate shifts. Volume confirms moves; high volume on ups is bullish.

I use free tools like Yahoo Finance. Practice on historical charts. This skill boosted my confidence in learn stock market investing.

Long-Term vs. Short-Term Investing

Long-term (years+) builds wealth steadily with compounding; pros: Lower taxes, less stress. Cons: Locked funds, inflation risk.

Short-term (months) seeks quick gains; pros: Liquidity, potential high returns. Cons: Higher taxes, volatility, emotional toll.

I favor long-term – my portfolio grew 200% over five years. Short-term? Fun but risky for beginners. Balance based on goals.

How to Control Emotions and Develop Patience

Emotions nearly derailed me – fear during dips, greed in booms. I set rules: Invest only what I can lose, ignore daily noise.

Journal feelings with trades to spot patterns. Meditation helped my patience. Remember: Markets recover; focus on why you invested. Patience turned my early losses into wins.

Tools and Resources I Use Daily

Daily, I check apps like Robinhood for quotes, Yahoo Finance for news. For analysis, TradingView's charts are gold. Books: "Rich Dad Poor Dad." Podcasts: "Invest Like the Best."

In 2025, AI tools like ChatGPT aid research. Free courses on Coursera teach basics. My go-to: Motley Fool for tips. These make stock investing tips for beginners accessible.

How to Keep Learning and Growing

Learning never stops. I read weekly, join forums like Reddit's r/investing. Track performance, adjust strategies. Attend webinars – Fidelity's are free.

Set milestones: From $1k invested to diversified portfolio. Growing means evolving with markets, like adding crypto cautiously.

My Personal Tips for Consistent Success

- Start small: Build habits without pressure.

- Diversify: Don't bet on one stock.

- Educate daily: 15 minutes reading pays off.

- Be patient: Compounding is magic.

- Track taxes: Use apps for records.

- Have fun: Invest in what excites you.

These kept me consistent in how to start investing in stocks.

The Journey from Beginner to Confident Investor

We've covered a lot – from stock market basics for beginners to strategies and pitfalls. Remember, every pro started where you are. My journey taught me investing is about growth, not perfection. With knowledge, you're set to thrive.

10 FAQs

What is the easiest way to start investing in the stock market? Open a brokerage app like DHAN, GROW, UPSTOCK, fund it, and buy an ETF – simple as that!

How much money do I need to start? As little as $1 with fractional shares on many platforms.

What are the safest investments for beginners? Index funds or ETFs tracking the S&P 500 – diversified and low-risk.

How can I learn stock trading for free? Use YouTube, Coursera, or Investopedia – tons of resources!

Is stock investing risky? Yes, but managed with diversification and long-term focus, it's rewarding.

How do I buy my first stock? Choose a broker, search the ticker, and hit buy – start with something familiar.

What is a demat account? It's a digital account holding shares electronically, common in some countries.

Can I lose all my money in stocks? Possible if undiversified, but unlikely with smart strategies.

What is the best strategy for beginners? Dollar-cost averaging into index funds.

How long should I hold my stocks? Ideally years for long-term growth, unless goals change.

Take That First Step Toward Your Financial Dreams

Imagine waking up one day, checking your portfolio, and realizing you've built something real – a future where money works for you, not the other way around. That's the magic I felt after my first big win, and it's waiting for you too. Don't let fear hold you back; start small today, whether it's opening an account or reading one more article. You've got the tools now – embrace the journey, stay curious, and watch how the stock market transforms your life. Your financial freedom starts with one brave step. Go for it!

I still remember the day I decided to buy my very first stock — I was nervous, uncertain, and full of questions. But I took that tiny step anyway. And that single decision changed the way I looked at money, opportunity, and my own potential forever.

If you’ve read this far, it means something inside you is ready to grow — ready to understand, explore, and take control of your financial destiny. The truth is, you don’t need to be an expert, a math genius, or have millions to begin. You just need the courage to start.

🌱 Every successful investor once stood exactly where you are right now — curious, unsure, but willing to learn.

Because the moment you start, the world of financial independence starts opening up for you.

Don’t let fear hold you back. The market rewards patience, learning, and courage — not perfection.

💬 If this guide inspired you even a little, share it with someone who dreams of financial freedom too. You might just change their life as well.

Disclaimer: This article is for educational purposes only and not financial advice. Investing involves risks, including loss of principal. Consult a professional advisor for personalized guidance.

Stock Market for Beginners, How to Invest in Stocks, Beginner’s Investment Guide, Stock Trading Basics, Learn Stock Market Investing, Financial Freedom Journey, Step-by-Step Stock Investing, Long Term Wealth Building, Simple Stock Market Strategies, Personal Finance Education, Smart Investing Tips, Stock Market Education, Investment for Beginners, Stock Market Learning Path, How to Start Trading Stocks, Build Wealth with Stocks, Safe Investments for Beginners, First Time Stock Investor, Stock Market Success Tips, Investing Made Simple

#StockMarket #StockMarketForBeginners #StockInvesting #StockTrading #LearnStocks #TradingForBeginners #InvestingBasics #StockMarketGuide #StockMarketEducation #InvestmentTips #Investing #InvestmentGoals #FinancialFreedom #WealthBuilding #MoneyMindset #FinanceTips #SmartInvesting #WealthCreation #FinancialEducation #PersonalFinance #StartInvestingToday #GrowYourWealth #FinancialJourney #SuccessMindset #MoneyMotivation #FreedomLifestyle #InvestInYourFuture #LearnAndEarn #MindsetMatters #DreamBigInvestSmart #StockMarketForBeginners #InvestmentJourney #StockMarketIndia #PassiveIncome #TradingMotivation #FinancialEducation #InvestingForBeginners #StockMarketLearning #WealthMindset #ProfessionalGrowth #HowToInvestInStocks #StockMarketExplained #InvestingMadeSimple #BeginnerInvestorsGuide

No comments:

Post a Comment